Why the Housing Market Won’t Crash

In the ever-evolving landscape of real estate, fears of a housing market crash often resurface, especially when economic uncertainties loom. However, current indicators suggest that such fears may be unfounded. Here’s why the housing market is poised for stability, if not continued growth.

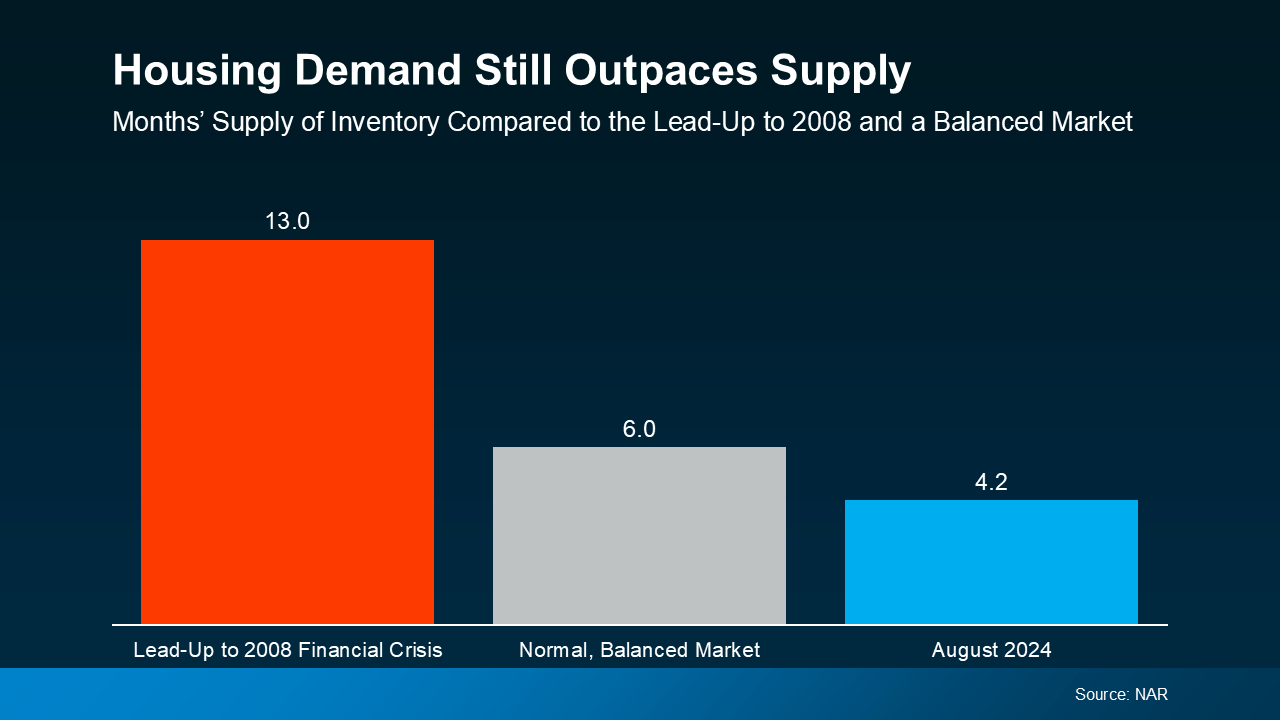

1. Demand for Homes Is Higher than Supply

One of the most compelling reasons why the housing market won't crash is the simple principle of supply and demand. Demand for homes is significantly higher than the available supply. This imbalance has been a consistent trend over recent years and shows no signs of abating. For buyers, this means that competition remains fierce, often leading to bidding wars and homes selling above asking prices. While this scenario can be frustrating for those looking to purchase a home, it serves as a robust indicator that the market is far from collapsing.

On the flip side, sellers find themselves in an advantageous position. With more buyers than available homes, properties are moving quickly and often at favorable prices for sellers. This seller's market is driven by various factors, including low mortgage rates and changing lifestyle needs—such as remote work—prompting many to seek new living arrangements. For sellers contemplating listing their homes, now continues to be an opportune time.

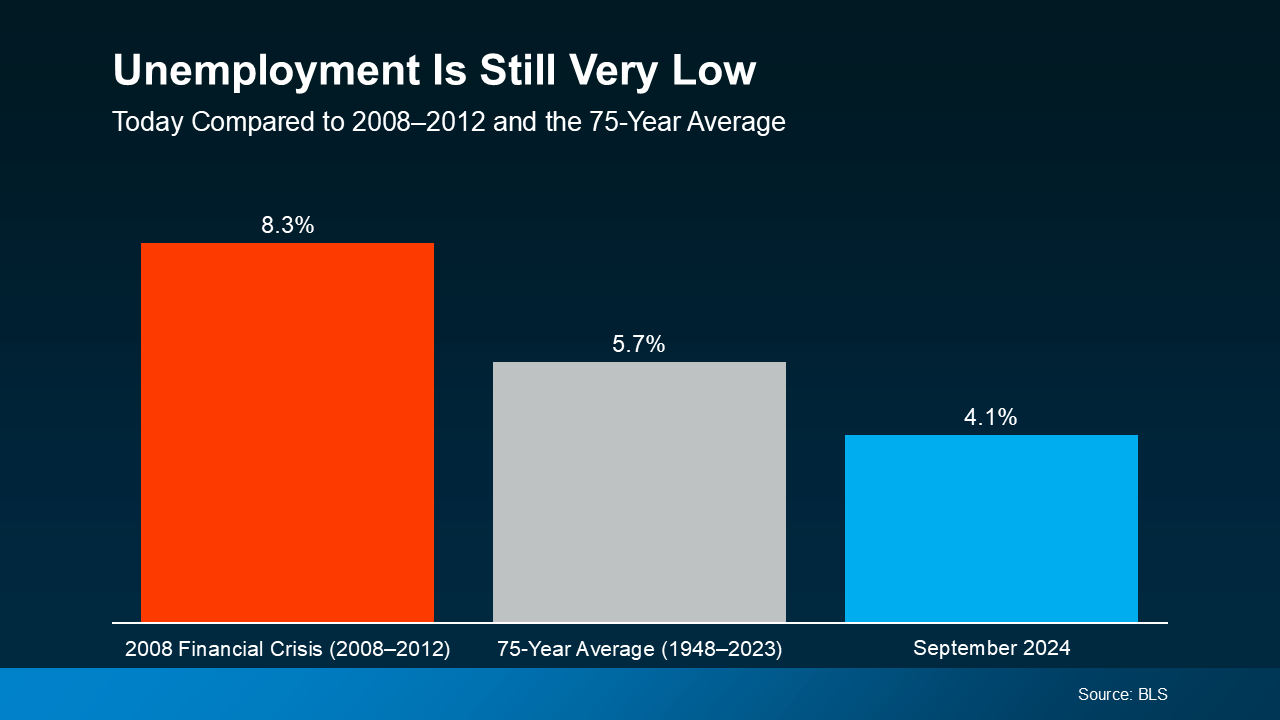

2. Unemployment Is Still Low

Another critical factor supporting a stable housing market is low unemployment rates. Despite economic challenges brought on by global events like the COVID-19 pandemic, unemployment rates have remained relatively low compared to historical standards. Low unemployment means more people have steady incomes, making them more likely to invest in real estate. Job security fosters consumer confidence, which in turn supports robust housing demand.

Real estate news consistently highlights these trends. Reports indicate that while there might be regional fluctuations and occasional slowdowns in certain markets, the overall trajectory remains positive. Analysts frequently point out that today's lending practices are much more stringent compared to those preceding the 2008 financial crisis. Stricter lending criteria mean fewer high-risk loans are being issued, reducing the likelihood of widespread defaults that could trigger a market collapse.

Moreover, demographic trends also play a significant role in sustaining demand for housing. Millennials—the largest generation in U.S. history—are now entering their prime home-buying years. This influx of first-time homebuyers adds another layer of demand to an already competitive market. Combine this with sellers being "locked in" to the low rates results in a lower supply. What does high demand and low supply do to the market? Prices increase.

It's also worth noting that real estate has historically been one of the most resilient asset classes during economic downturns. Unlike stocks or other investments that can fluctuate wildly based on investor sentiment or global events, real estate tends to hold its value better over time. This resilience makes it an attractive option for both individual buyers and institutional investors alike.

In conclusion, while no one can predict the future with absolute certainty, multiple indicators suggest that the housing market is not on the brink of crashing. The persistent demand for homes outstripping supply and low unemployment rates create a solid foundation for ongoing stability. Whether you're a buyer navigating competitive waters or a seller considering capitalizing on current conditions, understanding these dynamics can help you make informed decisions in today’s real estate landscape.

Stay tuned to real estate news and keep an eye on local market conditions to ensure you’re making the best choices for your unique situation. The sky isn't falling—in fact, it seems quite stable up there.

Questions? Comments? Don't hesitate to reach out to chat about how this impacts our local real estate market.

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 209627