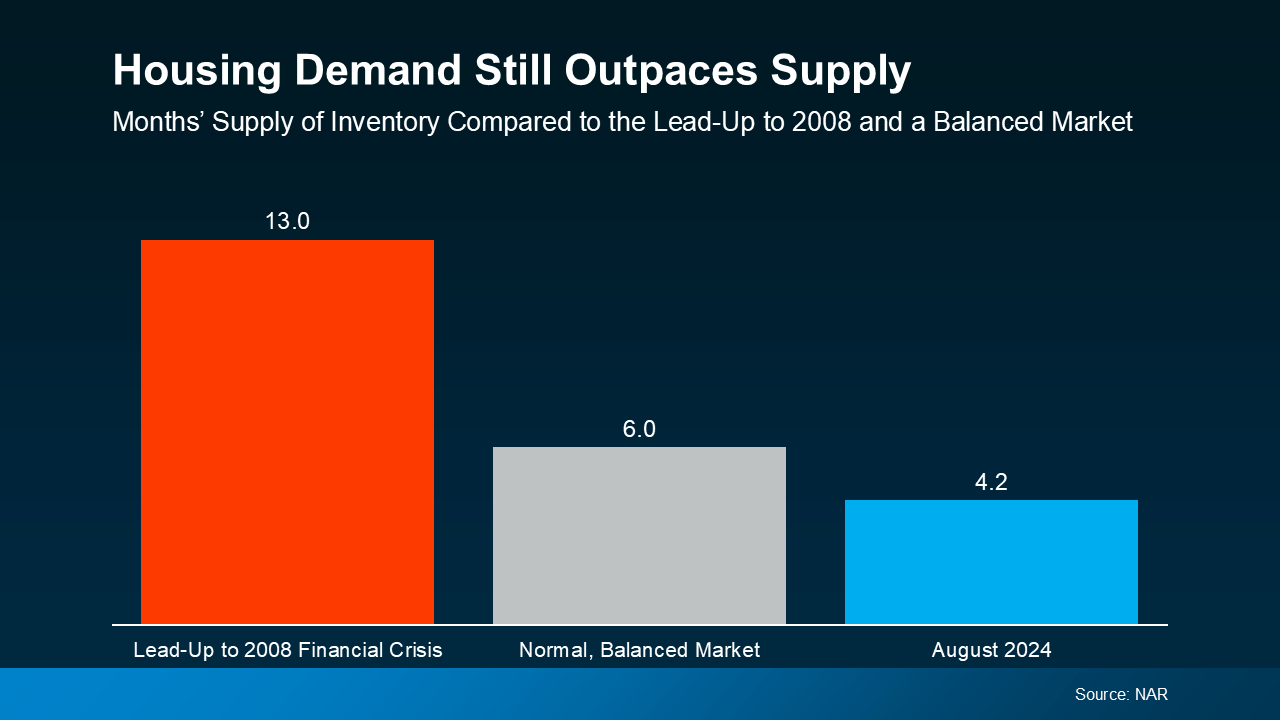

Why the Housing Market Won’t Crash

In the ever-evolving landscape of real estate, fears of a housing market crash often resurface, especially when economic uncertainties loom. However, current indicators suggest that such fears may be unfounded. Here’s why the housing market is poised for stability, if not continued growth. 1. Demand

Read More

Buying More House Than You Can Afford

The Biggest Mistakes Buyers Are Making Today Buyers face challenges in any market – and today’s is no different. With higher mortgage rates and rising prices, plus the limited supply of homes for sale, there’s a lot to consider. But, there's one way to avoid getting tripped up – and that’s leaning o

Read More

What Is Going on with Mortgage Rates?

What Is Going on with Mortgage Rates? You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data. Here’s a quick overview of what’s happening with mortgage rates and what experts say i

Read More

Should I Wait for Mortgage Rates To Come Down Before I Move?

Should I Wait for Mortgage Rates To Come Down Before I Move? If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you. In the housing mark

Read More

Categories