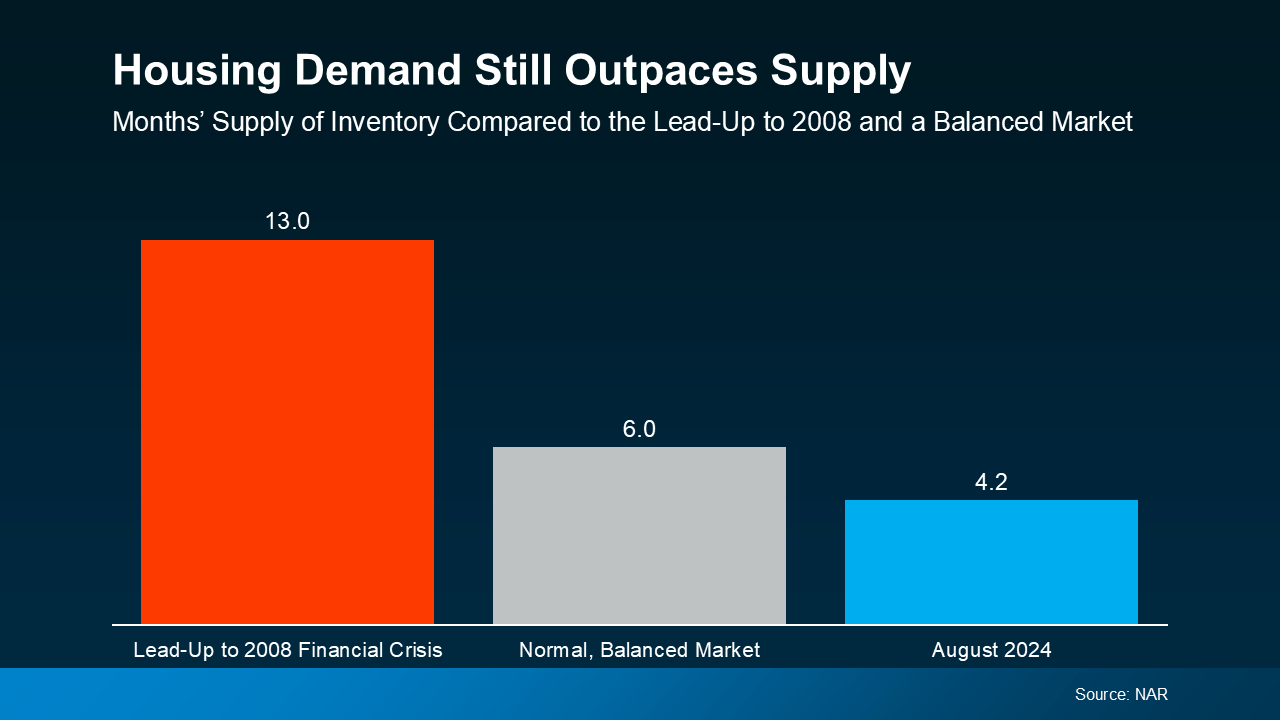

Buy now or wait?

Does It Make Sense To Buy a Home Right Now? Thinking about buying a home? If so, you're probably wondering: should I buy now or wait? Nobody can make that decision for you, but here's some information that can help you decide. What’s Next for Home Prices? Each quarter, Fannie Mae and Pulsenomics pu

Read More

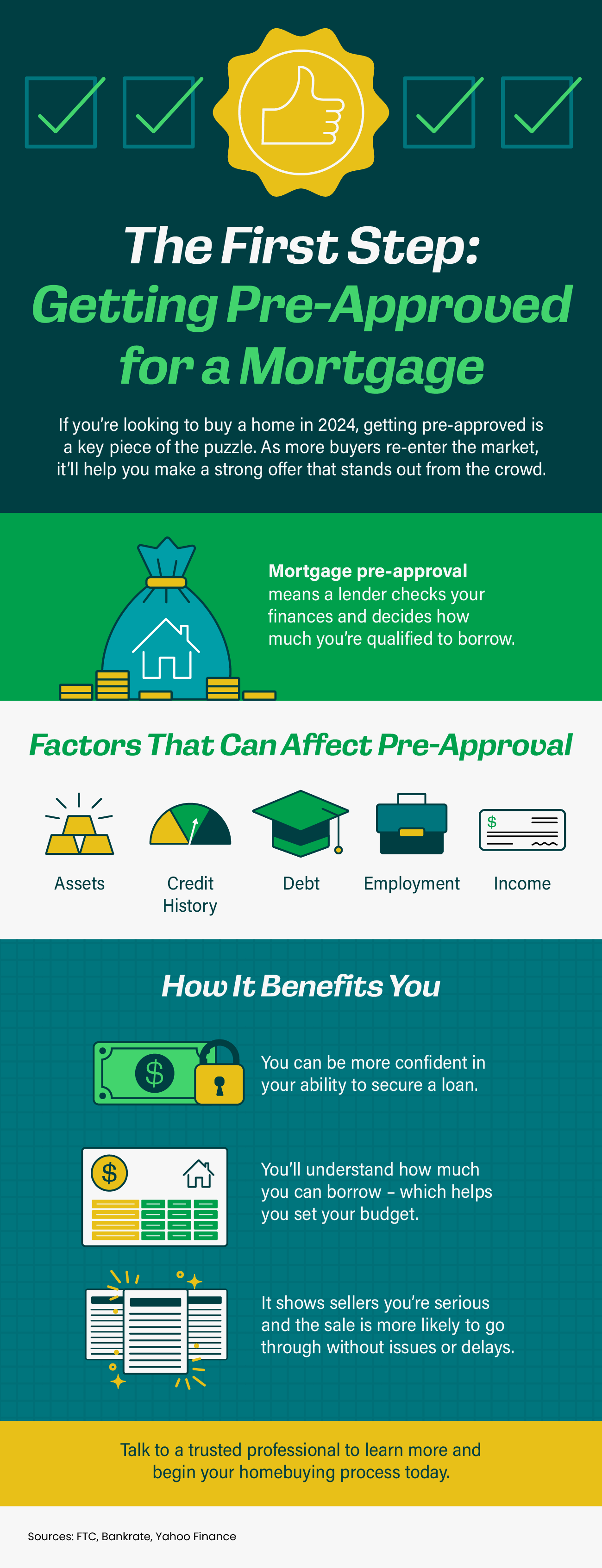

The First Step: Getting Pre-Approved for a Mortgage

Some Highlights A pre-approval is important because it helps you determine what the bank will allow you to purchase within a given needs/wants list. If the pre-approval doesn't align with what you are looking for in a specific area, you may need to revise that list. It's important to have this bef

Read More

Guide to the First Time Homebuyer

Guide to the First-Time Homebuyer Buying your first home is an exciting milestone in life. However, it can also be a complex and overwhelming process if you're not prepared. So, if you're a first-time homebuyer, here's a helpful guide to navigate you through the exciting world of real estate. 1. Und

Read More

Categories